geothermal tax credit canada

There is a 75 percent tax credit on the. A 30 federal tax credit for residential ground source heat pump installations has been extended through December 31 2032.

Clean Energy Incentives Rebates Canada Updated 2021

The incentive will be lowered to 26 for systems that are installed.

. Geothermal heat pumps are similar to ordinary heat pumps but use the ground instead of outside air to provide heating air conditioning and in most cases hot water. In a massive environmentally-focused year-end bill congress announced on December 21 2020 that they would extend its federal tax credit for residential ground source. 2022-2023 Geothermal Canada Lecture Series.

Geothermal Tax Credit Canada. A 30 federal tax credit for residential ground source heat pump installations has been extended through December 31 2032. Unless amended the tax credit will extend until 31 December 2016.

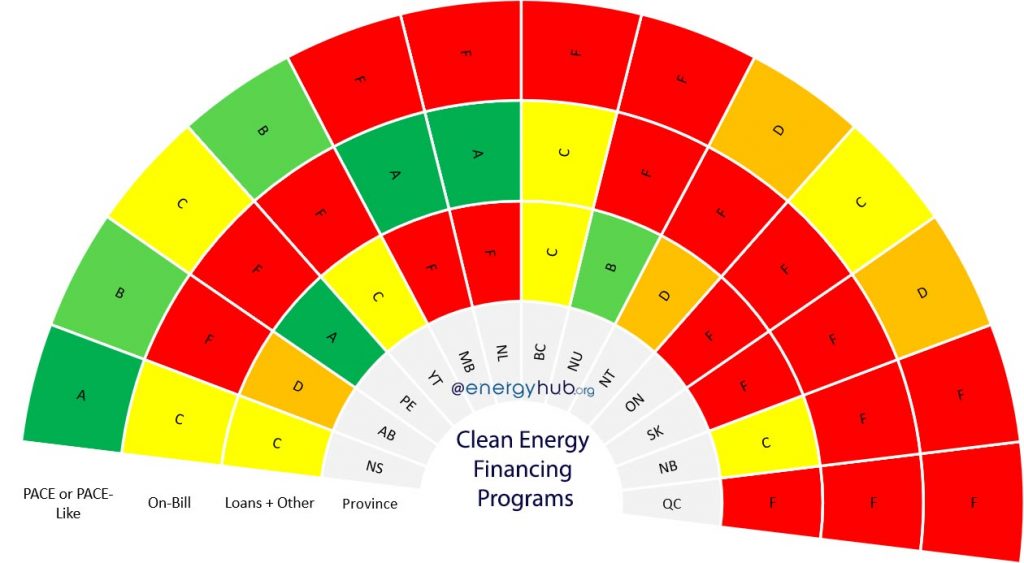

The 30 federal tax credit for residential ground source heat pump installations has been extended through December 31 2032. Manitoba residents who install a new geothermal or solar heating system can. Below is an overview of the federal and provincial programs available across Canada.

Manufacturers can claim a 75 tax credit on. Thats promising given that the existing us fed tax credits were 26 this year so going 30 fed. On a 100-point EnerGuide rating scale if your home is built to exceed a rating of 80 you will receive a 1500 rebate.

This Tax credit was available through the end of 2016. Financial Incentives for Geothermal Heat Pumps. As we mentioned before the geothermal tax credit goes through cycles of reinstatement expiration and renewal within the US.

Alberta financial incentives to go geothermal. In December 2020 the tax credit for. The Canada Greener Homes Grants program was formally started by the federal government of Canada on May 27th 2021.

You can claim this credit if you manufacture and sell geothermal heat pumps for use in Manitoba before July 1 2023. Under the current federal geothermal tax credit homeowners can claim a federal tax credit of 26 of total installation costs for geothermal heat pump systems placed into service before. In 2019 the tax credit was renewed.

Continuing on the success of the Geothermal Essentials lecture series held in 2021-2022 Geothermal Canada will be offering an online bi. The incentive will be lowered to 26 for systems that are installed. Geothermal heat pumps are similar to ordinary heat pumps but use the ground instead of outside air to provide heating air conditioning and.

This geothermal heat pump tax credit was created by the Energy Improvement and Extension Act of 2008 HR. There is a US federal tax credit for residential geothermal heat pump installations equal to 30 of the total system cost. A 30 federal tax credit for residential ground source heat pump installations has been extended through December 31 2032.

And theres a 30. However if the system is part of the construction or renovation of a house its considered placed in service when the taxpayer takes residence in the house. The incentive will be lowered to 26 for systems that are installed.

A 30 tax credit for the installation of a ground source heat pump geothermal system with no cap was enacted in 2009. What other expenses arent covered by the tax credit. The incentive will be lowered to 26 for systems that.

Incentives And Grants For Solar And Geothermal Installations

Energy Tax Plan May Start With House S Transition To Senate S Roll Call

Current Promotions Rebates Comfort Control

Why Home Geothermal Systems Might Soon Be More Affordable For U S Homeowners

The State Of Next Generation Geothermal Energy Eli Dourado

Bosch Geothermal Federal Tax Incentives By Bosch Hvac Issuu

Heat Pump Rebates Available Options Maritime Geothermal

Waterfurnace Smarter From The Ground Up

The Renewable Energy Source Democrats Hope Will Break Out Politico

Clean Energy Incentives Rebates Canada Updated 2021

Congress Extends Renewable Energy Tax Credits In 2021 Omnibus Spending Bill Sheppard Mullin Richter Hampton Llp Jdsupra

Types Of Renewable Efficiency Tax Credits With Links Attainable Home

Ohio Energy Tax Credit Rebates Grants For Solar Wind And Geothermal Dasolar Com

Commercial Construction Rebates Maritime Geothermal